Listen to the article – Possible Effects for the Global Trade and EU Economy, Commentary on the Unfolding Red Sea Crisis

The current situation in the Red Sea with continuing attacks on the cargo ships and tankers coupled with a real possibility of complete blockade of the Suez Canal cause major concerns for the global trade and economic perspectives of the European Union. Although the Red Sea transportation corridors are not the world’s largest supply lines[1], they are essential for the EU economic stability.

The following is a brief analytical overview of the effects and likely concerns of the Red Sea crisis for global trade and EU economy. The commentary covers economic concerns for the EU, global concerns, strengthening of regional powers and the formation of new geopolitical alliances, and lastly possibility of forming new alliances and establishing alternative routes.

01

Economic Concerns for EU

01

Economic Concerns for EU

Price hikes for goods and services

Redirecting cargo flows around the Suez Canal will significantly increase delivery times and fuel costs. This will affect the cost of goods imported from Asia, which includes electronics, textiles, home appliances and other consumer goods that have considerable added value due to their diverse component base and labor.

- Increased transportation costs: Redirecting[2] cargo traffic around the Suez Canal will significantly increase the distance and fuel costs of shipping goods, especially from Asia. The higher costs will be covered by importers, which means – they will likely be reflected in final prices for the end consumers. Price hikes for consumer goods would slow down trade and consequently the tax revenue for EU countries.

- Supply chain disruptions: A blockade of the Suez Canal or increased tensions in the region could lead to disruptions in the supply of raw materials and components needed for EU production lines. This could impact prices[3] of finished products, especially those that are sensitive to component costs, such as electronics, clothing, and automobiles.

- Speculation and rush: The uncertainty caused by the crisis may lead to speculative price increases on the part of some producers and sellers. The rush among consumers eager to stock up on essential goods will be additionally driving up prices.

How can we help?

Intelligence Solutions

The combination of business, market and strategic intelligence ensures result-driven outcomes for our customers.

Risk management

Risk management through the responsibility of taking risk ownership while ensuring safety and security

Strategic Advisory

The first step in protecting your organization, assets and people is the identification of the risks and threats.

Shortages of consumer goods

In addition to rising prices, the crisis in the Red Sea could lead to a shortage of several goods, negatively affecting consumers and businesses. The key factors influencing this situation include:

- Dependency on key routes[4]: The EU heavily relies on supplies through the Suez Canal and the Red Sea for raw materials and components necessary for various industrial sectors. A blockade of the canal or disruptions in navigation in the region could lead to serious supply chain disruptions.

- Limited alternatives: Not all goods can be easily rerouted through alternative routes. Transport through other channels, such as the Panama Canal or the Northern Sea Route, is more expensive and less efficient.

- Duration of the crisis: The longer the crisis lasts, the higher the likelihood of shortages[5]. Producers may deplete their stocks of raw materials and components, leading to production disruptions and delays in the delivery of finished products.

Rising inflation and slowing economic growth

The increase in prices for goods and services, as well as possible shortages, can lead to further inflation growth in the EU[6], which is already at a high level.

This can reduce consumers’ purchasing power and investment activity, negatively affecting the EU’s economic growth. The increase in prices[7] for goods and services, along with possible shortages, can lead to further inflation growth in the EU, which is already at a high level. This can have several negative consequences for the economy:

- Decrease in purchasing power: Higher prices reduce consumers’ purchasing power, leading to a decrease in demand for goods and services. This negatively affects business sales and can lead to job cuts.

- Increase in interest rates: To combat inflation, central banks may increase interest rates, making loans more expensive for businesses and households. This can lead to a decrease in investments and a slowdown in economic growth.

- Uncertainty for businesses: The uncertainty caused by the crisis can lead businesses to postpone investments and hiring, further impacting economic growth.

02

Global Concerns

02

Global Concerns

Degradation of Global Trade

The crisis in the Red Sea could lead to a considerable slowing of the global trade, negatively affecting the economy of all countries[8]. Furthermore, an increase in transportation costs and supply disruptions may lead to a significant change of production chains and a decrease in the efficiency of the global economy[9].

Here are some key aspects to consider:

- Impact on trade volumes: The increase in transportation costs can make trading certain goods unprofitable, which would inevitably cause a decrease in their volumes. Supply disruptions can also disrupt production chains, limiting the production and export of finished products.

- Concerns for developing countries: Many developing countries depend on trade through the Red Sea for the export and import of goods. The crisis could lead to a reduction in their revenues and, as a result – worsen their economic situation.

- Possible geopolitical consequences: A decrease in global trade can lead to increased competition between countries for resources and markets, which in turn would exacerbate the already existing geopolitical tensions.

Threat to the Dominance of the Dollar and Euro in International Trade

The crisis in the Red Sea could accelerate the search for alternative trade routes. This will push the traders to seek alternative settlement systems, which are not linked to the dollar and euro. This could lead to a weakening of these currencies’ positions[10] on the global stage. In addition to direct economic damage, the crisis in the Red Sea could have several long-term geopolitical consequences, including:

- Search for alternative currencies: The crisis could speed up the search for alternative currencies to be used in international trade. Countries affected by the crisis might start using regional currencies or the yuan for trading with each other, weakening the positions of the dollar and euro on the global stage.

- Strengthening financial independence: The crisis might encourage countries to develop their own financial systems and reduce dependency on dollar settlements[11]. This could lead to the fragmentation of the global financial system.

- Possible sanctions: If the crisis triggers a military conflict, sanctions could be imposed on the countries involved, further limiting their use of the dollar and euro.

03

The strengthening of regional powers and the formation of new geopolitical alliances

03

The strengthening of regional powers and the formation of new geopolitical alliances

The crisis in the Red Sea could lead to the raise of regional powers such as Saudi Arabia, Egypt, and Iran. These countries may use their geographical position and control over key trade routes to gain political, strengthen their influence and obtain economic concessions from other countries.

Furthermore, the crisis could lead to the emergence of new regional blocs and free trade agreements that exclude the United States and the European Union. This could further weaken their traditional economic and political influence in the region.

Strengthening of Regional Powers

The crisis in the Red Sea has already increased the geopolitical relevance and influence of regional powers such as Saudi Arabia, Egypt, and Iran. Given the fact that these countries possess strategic advantages, their influence is likely to grow further.

In general terms, the advantages of the regional powers can be summed up along the following lines:

Download Report

Possible Effects for the Global Trade and EU Economy

Commentary on the Unfolding Red Sea Crisis

A brief analytical overview of the effects and likely concerns of the Red Sea crisis for global trade and EU economy.

- Geographical position:

- Economic Opportunities

- Military Potential:

- All three countries have developed armed forces[17] with regional outreach and considerable capabilities.

- All three countries have seasoned military personnel, which participated in various conflicts in the region over the past three decades.

Saudi Arabia, Egypt and particularly Iran are likely to use the geopolitical opportunity and leverage their advantages, which can include the following aspects:

- Control over trade routes:

- Countries can increase revenues from transit fees and exert political influence over dependent countries[18].

- Attract investments in port and transport infrastructure are possible.

- Form new regional alliances:

- The crisis may stimulate the creation of new groups and blocs excluding the US and EU.

- New alliances and blocks will further strengthen regional economic and political independence[19] and distance the region from its traditional western patronage.

Weakening of US and EU Influence

As was noted, the crisis in the Red Sea and the changing geopolitical landscape are likely to have far reaching consequences. One such consequence is the eventual weaking of the US and EU influence in the region and globally.

The following are the main precipitators of the expected shifts:

- Decrease in trade volumes: The reorientation of trade flows can reduce trade volumes with the region.

- Loss of control over key routes: Weakening control over maritime routes can reduce influence on regional security.

- Rise in anti-Western sentiment: The strengthening of regional powers can lead to anti-Western sentiments.

Consequences for World Trade

The strengthening of regional powers and potential formation of new alliances can have long-term consequences:

- Fragmentation of global trade: The emergence of regional blocs with different trade rules and free trade agreements can lead to the fragmentation of global trade. This can increase the complexity of doing business and create uneven conditions for companies from different regions.

- Increase in trade costs: The reorientation of trade flows to alternative routes, such as the Northern Sea Route, can lead to an increase in transportation expenses and transit fees. This can affect the prices of consumer goods and reduce the competitiveness of companies.

- Instability in global markets: Uncertainty caused by the crisis in the Red Sea and the formation of new alliances can lead to instability in the global commodity markets. This can negatively impact investments and economic growth worldwide.

04

Potential Hidden Alliances and Alternative Trade Routes

04

Potential Hidden Alliances and Alternative Trade Routes

The crisis in the Red Sea may create a unique opportunity for the formation of hidden alliances among countries interested in advancing alternative trade routes at the expense of traditional corridors, particularly – the Suez Canal.

The following are potential examples of such alliances and their alternative routes:

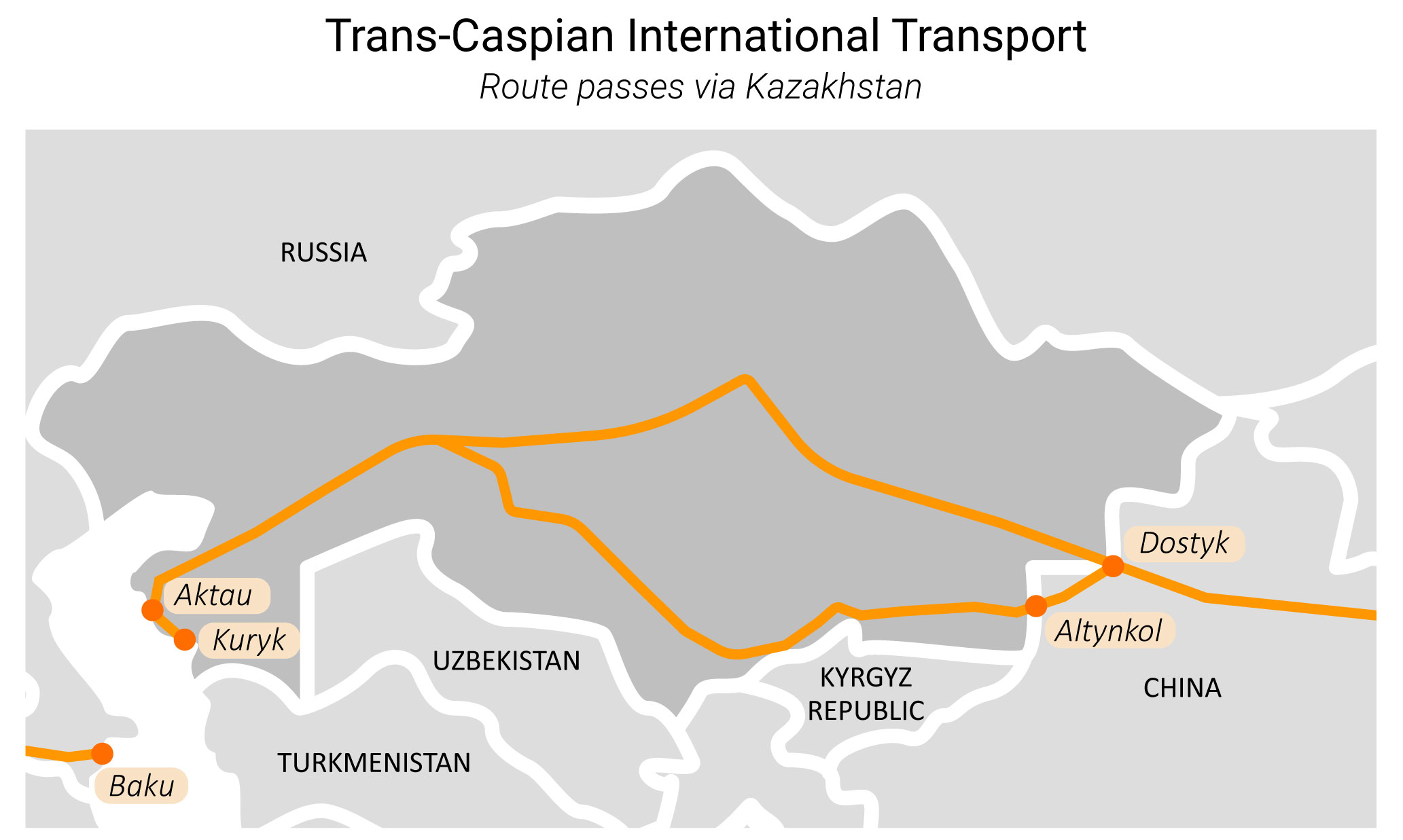

Central Asia and Caspian Sea Alliance

TITR is a multimodal corridor with a length of 6,180 kilometers. The total Trans-Kaspian International Corridor throughput capacity is estimated to be at six million tons, including 80,000 TEU.

- Participants: Kazakhstan, Turkmenistan, Azerbaijan, Russia.

- Route: The Trans-Caspian International Transport Route (TITR), connecting Central Asia with Europe via the Caspian Sea and the railways of Azerbaijan, Georgia, and Turkey.

- Motivation: To develop the transit potential of Central Asian countries, reduce dependence on the Suez Canal, and increase economic ties with Europe.

- Challenges: Underdeveloped infrastructure, political instability in some regions.

East Africa and Red Sea Alliance

- Participants: Ethiopia, Djibouti, Kenya, Saudi Arabia.

- Route: Ports of Djibouti and Mombasa, Ethiopia-Djibouti railway.

- Motivation: To develop the port infrastructure of East Africa, attract more maritime traffic to the Red Sea bypassing the Suez Canal, increase transit revenue.

- Challenges: Limited port capacity, piracy in some areas.

South Asia-Persian Gulf Alliance

The South Asia-Persian Gulf alliance represents a potential alliance of the countries forming two separate corridors – Persian Gulf segment (Iran and Oman) and South Asia – Russia segment (Azerbaijan, Russia). The second segment is also known as the International North – South Corridor (see further in the text).

- Participants: India, Iran, Oman

- Composite Route: Chabahar Port (Iran) and Duqm Port (Oman), International North-South Transport Corridor (INSTC) through Iran and Central Asia

- Motivation: To develop alternative routes for trade between India and Europe, reduce dependence on the Suez Canal, and improve economic ties with Central Asia

- Challenges: Sanctions against Iran, political instability in the region

International North-South Transport Corridor (INSTC) via Russia

The International North-South Transport Corridor (INSTC) is a 7,200-kilometer multimodal transport route connecting India, Iran, Azerbaijan, Russia, Central Asia, and eventually Europe.

Route:

The INSTC utilizes a combination of sea, rail, and road routes:

- Maritime Route: Indian ports like Mumbai and Mundra to Iranian ports like Chabahar and Bandar Abbas.

- Western Branch: Railways through Azerbaijan and Georgia to Black Sea ports and Europe.

- Eastern Branch: Railways through Turkmenistan, Kazakhstan, and Russia to Baltic Sea ports and Europe.

Motivation:

- Develop alternative trade routes between India and Europe, reducing dependence on Suez Canal.

- Improve economic ties between India, Russia, and Central Asian countries.

- Decrease transport costs and time compared to traditional routes.

Challenges:

- Sanctions against Iran: Limits investment and infrastructure development in Iran, a crucial segment of the route.

- Political instability in the region: Security concerns and bureaucratic hurdles can disrupt operations.

- Underdeveloped infrastructure: Requires significant investment in ports, railways, and roads across various countries.

- Limited cargo volume: Currently handles relatively low volumes compared to established routes.

Current Status:

- Some sections of the INSTC are operational, like the maritime route and parts of the western branch.

- Completion of the entire corridor faces challenges mentioned above.

- Recent developments indicate increased interest from Russia and India in developing the INSTC due to geopolitical tensions and potential disruptions to other routes.

Additional Information:

- The INSTC is part of a larger initiative called the North-South Transport Corridor, which also includes plans for a separate route via the Caspian Sea.

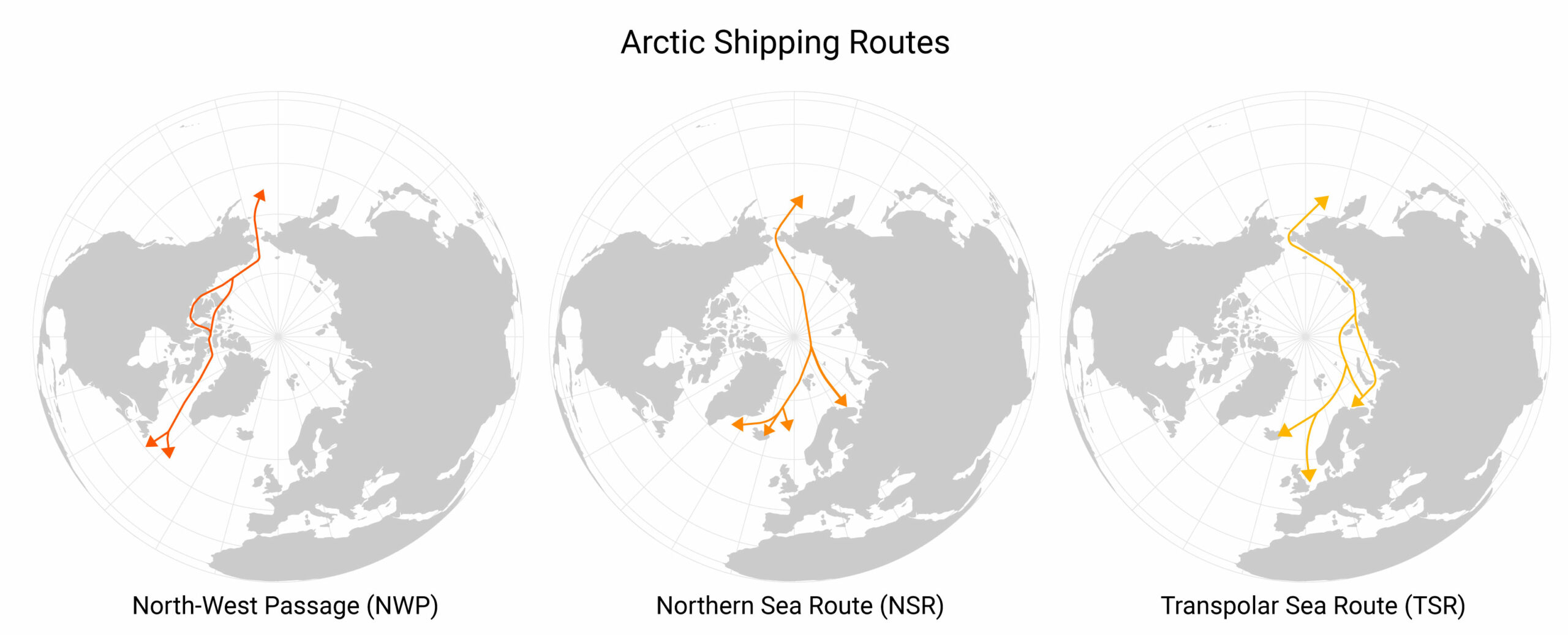

Northern Sea Route Alliance

The NSR is a 5,600-kilometer maritime route that connects the Atlantic and Pacific Oceans via the Arctic Ocean.

- Participants: Russia, China, Norway

- Route: The Northern Sea Route (NSR) along the Arctic coast of Russia

- Motivation: To develop the NSR as a shorter route between Asia and Europe, especially for bulk commodities, attract investment in infrastructure, and secure a strategic advantage for Russia

- Challenges: Harsh climatic conditions, limited navigation in winter, environmental concerns

05

Conclusion

05

Conclusion

The Red Sea is a crucial transportation corridor for the global trade. Since October 2023 it faces increasing instability with frequent attacks on cargo ships and tankers. The situation was further exacerbated by the potential threat of Suez Canal complete closure – a development that might have almost catastrophic consequences, particularly for the European Union.

While the Red Sea is not the world’s largest trade corridor, any disruption in the region would have a cascading effect globally. Bypassing the Suez Canal and rerouting cargo around Africa would result in significant increases in transportation costs and extended delivery times, leading to price hikes for various imported goods. This, in turn, could negatively impact consumer spending and tax revenues for the European nations.

Furthermore, potential blockades and escalation of already ongoing tensions could disrupt the flow of raw materials and components that are essential for the EU high-tech production lines. This can lead to shortages of consumer goods and increased production costs, impacting various industries in EU and other regions.

The crisis in the Red Sea is likely to urge various regional powers to form new alliances to mitigate the economic consequences. Regional powers like Saudi Arabia, Egypt, and Iran, controlling key trade routes are expected to use their positions for political and economic gains. New regional blocs excluding traditional players like the US and EU are likely to emerge.

Such situation may stimulate revisiting and further development of alternative trade routes like the Trans-Caspian International Transport Route or the Northern Sea Route. Should such scenario materialize, a number of new geopolitical players are expected to claim for their share of the global trade. Moreover, the tandem of China and Russian Federation are expected to enforce their standing and global influence as most of the alternative routes would cross the territories that are either directly under their control or where they have considerable influence.

ARTICLE | 22 PAGES

Possible Effects for the Global Trade and EU Economy

Commentary on the Unfolding Red Sea Crisis

![Possible Effects for the Global Trade and EU Economy <br><em>Commentary on the Unfolding Red Sea Crisis</em><br><span>[7 minutes read]</span>](https://t-dynamics.com/wp-content/uploads/2024/02/Title_red-sea-crisis.jpg)